How does a Pre-Tax Account work?

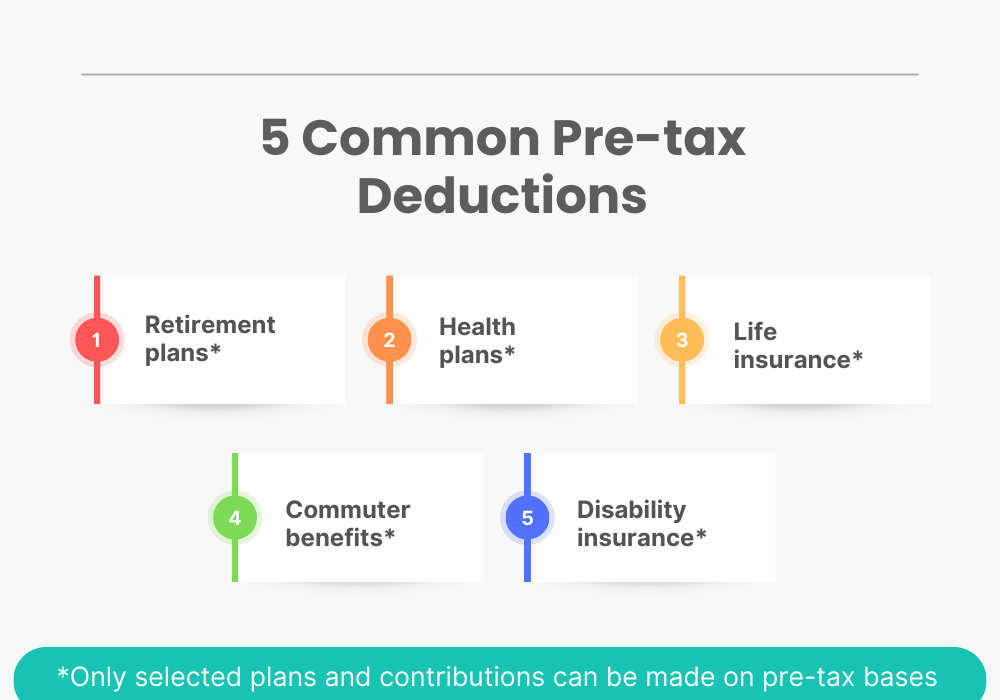

Pre-tax Deductions and Contributions?

What Are Pre-tax Deductions: Before Tax Deduction Guide

Traditional vs. Roth IRAs: What's the Difference? — Fi3 Advisors

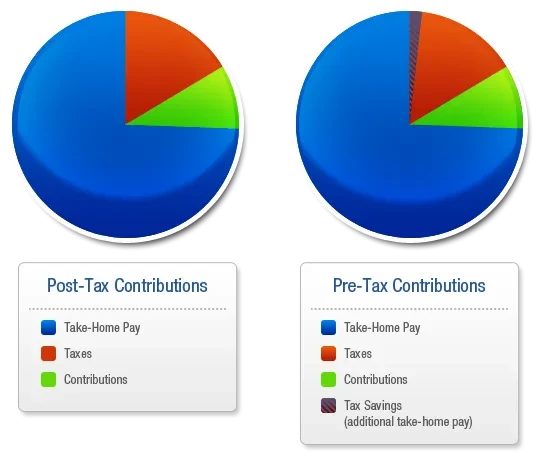

How does a Pre-Tax Account work?

How does a Pre-Tax Account work?

Pre-tax Versus Roth Contributions to Retirement Accounts – Which Is Better? – Part 1

What is Net Unrealized Appreciation?

Should You Make Pre-tax or Roth 401(k) Contributions?

Start Your Enrollment in a Paychex 401(k) Today

Health Care Flexible Spending Account (FSA) – Is a pre-tax benefit account that helps you to save money while paying for healthcare expenses for yourself. - ppt download

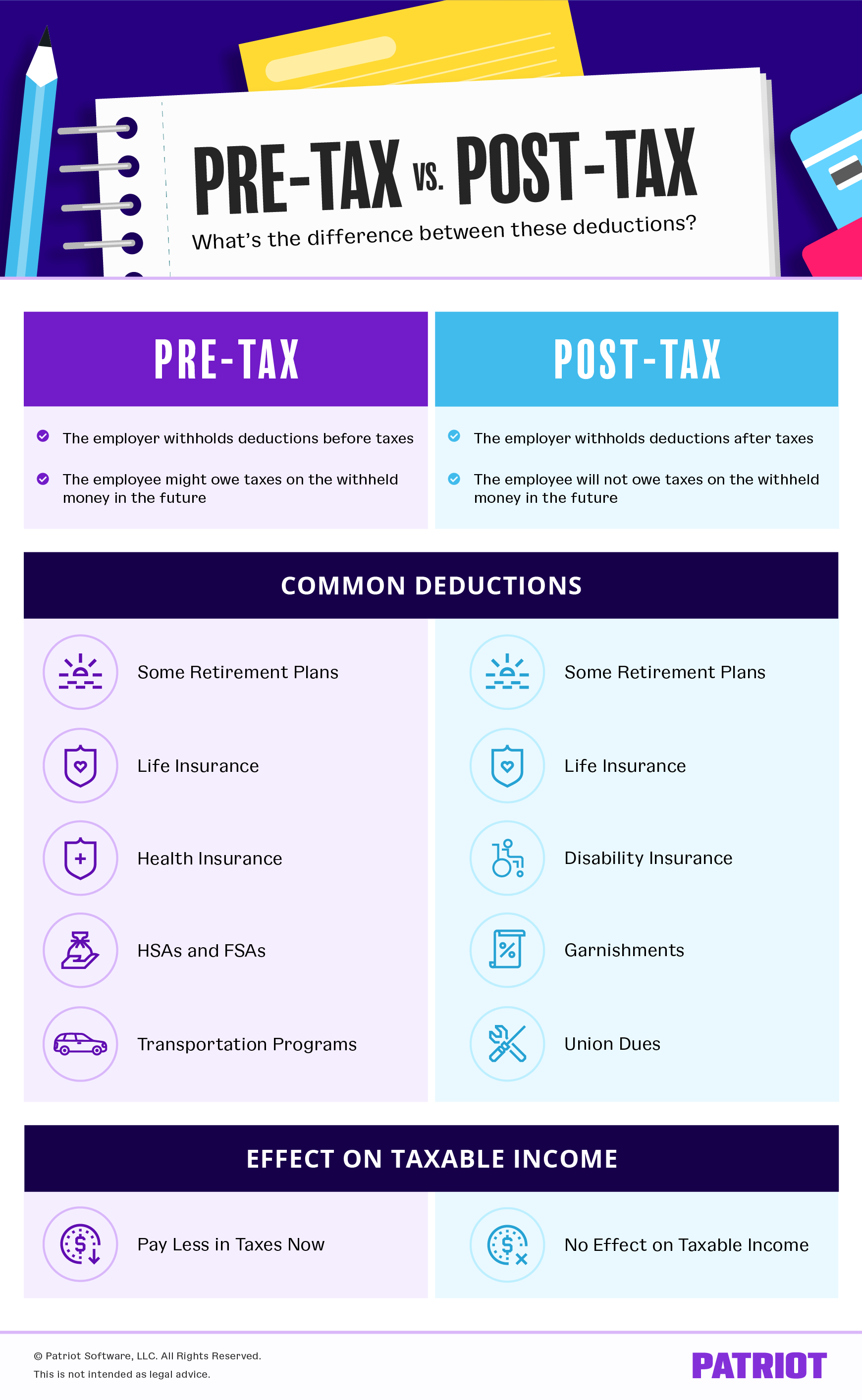

Pre-Tax vs After-Tax, Human Resources

Pretax Income - Definition, Formula, Example

Participant Contribution Types: What's the Difference Between Roth and Pre- Tax Contributions? What Are After-Tax Contributions? – Vestwell Help Center

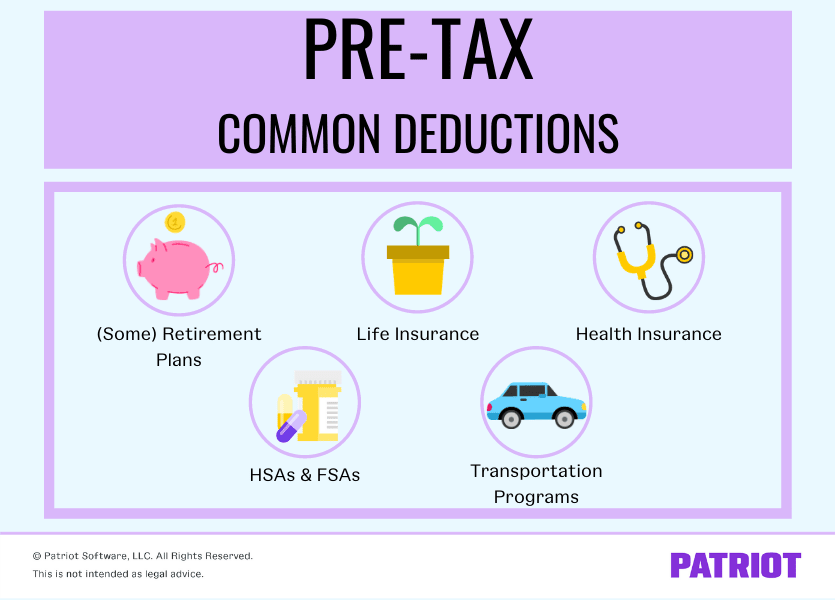

What Are Pre-Tax Deductions?

Pre-tax vs. Post-tax Deductions - What's the Difference?